African American Maritime History Series #2: Emergent Marine Insurance and Insuring the Enslaved

Early emergence of the insurance industry was a result of the need for insuring the ships carrying enslaved Africans to the Caribbean, North America, and other points in the Diasporic world. A significant element that enabled the transatlantic slave trade to grow to such dynamic proportions was the capability of the ship owners and investors to discover methods to navigate the usual risks of trans-oceanic commerce in a pre-industrial age, but also the unique risks peculiar to the trade itself. The latter encompassed high crew and enslaved morbidity rates, highly variable capacity rates and ocean crossing times, the di"iculties of provisioning, the moral hazard of crew negligence, losses caused through shipboard revolt or resistance, and a variety of transaction risks, including exchange value uncertainties, price volatility and planter credit default in the purchase of the newly enslaved. Historians have noted how failure to manage such risks undermined the trading capacities of some companies involved in the enslaving business (Carlos, 1994).

The insurance of enslaved persons at sea was already known in the fifteenth-century Mediterranean, where small numbers were occasionally included in policies covering maritime cargoes (Del Treppo 1957). "From the late seventeenth century onward the expansion of transatlantic commerce raised it to an entirely new level." (“Insuring the Transatlantic Slave Trade - Cambridge Core”) The annual average number of enslaved persons carried by British ships in the first half of the eighteenth century rose by 68 percent, a faster increase than that of shipping tonnage and probably Atlantic trade in general. By the 1720s London insurers included the enslaved trade among so-called “cross risks,” that is ships or cargoes traveling between two or more foreign destinations outside the United Kingdom. In 1731 as much as 42 percent of marine insurances sold by the London Assurance Corporation were “cross risks.” For private underwriters the percentage was probably higher, especially when the two London insurance corporations withdrew from the cross-risks market during wartime. The advent of insurance for enslaved cargo ships was the predecessor of marine and property insurance as we know it today.

During this time, a basic system for funding voyages to the New World was also established. Initially dealers and firms would solicit funding from the venture capitalists of that day. They, in turn, would help find people who wanted to be colonists, usually those from the more desperate areas of London. In exchange, the venture capitalists were guaranteed profits based on the results of what the colonists would produce or find in the Americas. It was widely believed during that time that prospecting in America would result in guaranteed riches. When the results proved that this wasn't precisely factual, venture capitalists were still willing to fund voyages for a share of the new mega crop in the Lowcountry: Rice.

After a voyage was secured by investors, the brokers and ship owners went to Lloyd's of London to submit a copy of the ship's cargo manifest (which included human enslaved persons) so the underwriters who gathered there could read and verify it. Those who were interested in taking on the risks signed at the bottom of the manifest beneath the figure indicating the share of the cargo for which they were taking responsibility (hence, the development of the term underwriting). In this way, a single voyage would have multiple underwriters, who agreed to limit their individual risk by buying shares in several di"erent voyages. Ultimately, property insurance underwriting throughout the world was conceived from this model of insuring the enslaved as cargo.

In the 1800s, enslavers made extra income beyond their agricultural production by renting out their enslaved persons especially those with specialized skills. In the event that their enslaved persons, whom they considered property died, or were severely injured in the hands of someone else, the owners would not su"er too much of an economic loss. Within this situational necessity, the genesis of slave insurance emerged.

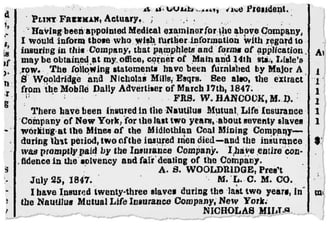

In most of the Southern states, New York Life, which was known as The Nautilus Insurance Company at the time, was the largest insurer of enslaved humans. The policies helped New York Life establish an early foothold in the South, which distinguished it from its larger competitors. (“Insurance Policies on Slaves: New York Life’s Complicated Past”) Between 1845 and 1848, New York Life sold policies to enslavers to insure their enslaved population against damages or death. James De Peyster Ogden, New York Life’s first president, would later describe the American system of human bondage as “evil.” But by 1847, insurance policies on enslaved persons accounted for a third of the policies in a firm that would become one of the nation’s Fortune 100 companies. Slavery was finally abolished in New York in 1827. But the plantations in the South continued to generate business in New York City in the decades before the Civil War, according to Eric Foner, a historian at Columbia University.

New York City’s merchants and Wall Street helped to finance some of the nation’s premier export crops, rice, indigo, tobacco and cotton, and the purchase of the land and slaves needed to grow it. They controlled the boat companies that shipped the products to Europe, leading one Southern editor to describe New York City as “almost as dependent upon Southern slavery as Charleston.” And some of these businessmen assumed prominent positions at New York Life. By the 1840s, the number of enslaved persons insured in the South was about the same as the number of free whites with life insurance. It was rare that enslaved plantation laborers were insured. Insurance agents continued to insure White lives in the region long after the slave policies were discontinued using the established model.

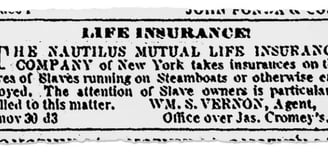

An ad taken out by Nautilus Mutual Life Insurance in 1847 in the Daily Democrat newspaper in Louisville, K.Y. o"ering slave policies. Nautilus was renamed New York Life Insurance in 1849.

Enslavers would insure their enslaved captives with specialized expertise such as coal miners, blacksmiths, carpenters, railroad workers, maritime workers such as ship carpenters, loaders, drivers and other slaves with valued skills. Miners, for example, made up approximately 15.4 percent of the insured enslaved workforce. Maritime workers accounted for approximately 12.6 percent of those insured and domestic workers accounted for approximately 14.6 percent of the insured slave population, according to insurance and plantation ledgers. Another reason for insuring these categories of enslaved persons was because of the increased mobility that they had in their roles.

The slave insurance industry helped establish the model for the life insurance industry for free citizens. Insurance companies during that time tended to view industrial slaves—and those who had extensive experience in managing plantation households—quite di"erently. The most highly valued slaves were domestic workers with decades of experience and intimate knowledge about how to run a household, artisans (like blacksmiths and shoemakers), workers with highly coveted expertise (like butchers and clerks), and those who excelled in especially dangerous industries (like railroad and steamboat workers, or coal miners.

New York Life — known as the Nautilus Mutual Life Insurance Company in the mid-1840s — placed an ad in the Richmond Enquirer in 1846, o"ering insurance of slaves employed in a variety of occupations.

Between the time that the Atlantic slave trade to the United States was outlawed, in 1808, and slavery was abolished, in 1865, slave life insurance became a crucial element of industrial insurance, a key feature of slave shipping, and a central element of credit networks throughout the agrarian South. By the 1860s, approximately 31 percent of urban slaves were hired out, compared to 6 percent of rural slaves.

Support for this series provided by:

Artwork provided by (c) Jonathan Green